GoI could reduce highest tax bracket limit to Rs 25 lakh

If the limit is raised to Rs 25 lakh per year, a taxpayer earning more than Rs 30 lakh annually could save Rs 1.04 lakh each year.

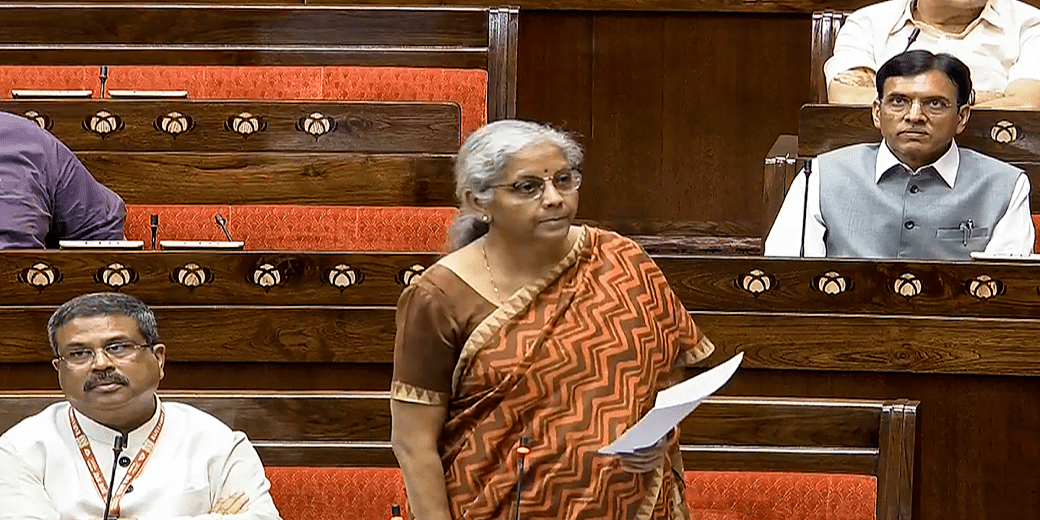

The interim budget is on the way. In the last budget, the government had made several changes to make the new tax regime attractive. Despite this, 60 percent of taxpayers in the country still prefer the old tax regime. Experts believe that if the government wants to make the new tax regime more popular, they need to make several improvements in this system. The government will have to make changes in the personal tax rates to make the new tax regime attractive.

Tax rates will need to be increased:

Tax experts suggest that the government could increase the limit of income tax slab with highest income tax rate from the current Rs 15 lakh to Rs 30 lakh. Currently, GoI levies maximum tax rate of 30 per cent on the highest tax bracket. Alternatively, the threshold rate could be reduced to 25 percent. These changes would enable taxpayers to save more on taxes. This would encourage taxpayers to adopt the new tax system, leaving the old system behind.

Save Rs 1 lakh every year:

If the limit is raised to Rs 25 lakh per year, a taxpayer earning more than Rs 30 lakh annually could save Rs 1.04 lakh each year. Analysis shows that those earning Rs 25 lakh could save Rs 98,800.

How will you get the relief?

If the budget increases the tax rate limit to Rs 20 lakh, taxpayers earning more than Rs 25 lakh per year could save Rs 52,000. Similarly, a taxpayer earning Rs 20 lakh per year would save an additional Rs 46,800 each year. However, this would not affect those earning Rs 10 lakh or lower every year.