Vegetables add to RBI worry on inflation

RBI said the uneven monsoon is a cause for concern and can adversely impact inflation

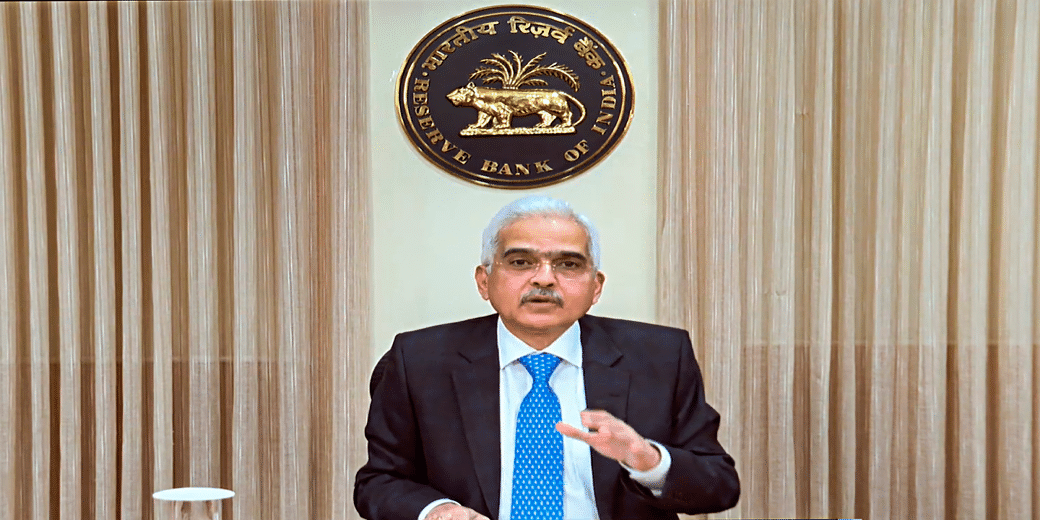

The Reserve Bank of India on Thursday maintained its GDP growth projection for 2023-24 at 6.5 per cent. Commenting on inflation, governor Shaktikanta Das said higher vegetable prices, led by tomatoes, would exert sizeable upside pressures on the near-term headline inflation trajectory. It raised inflation projection to 5.4 per cent.

While unveiling the bi-monthly monetary policy, Das said domestic economic activity is maintaining resilience.

The recovery in kharif sowing and rural income will help the economy to sustain demand for consumer goods. “Headwinds from weak global demand, volatility in global financial markets, geopolitical tensions and geoeconomic fragmentation, however, pose risks to the outlook,” Das said.

Considering all these factors, the real GDP growth for 2023-24 is projected at 6.5 per cent with first quarter at 8 per cent; second quarter at 6.5 per cent; third quarter at 6.0 per cent; and fourth quarter at 5.7 per cent.

Real GDP growth for Q1 of 2024-25 is projected at 6.6 per cent.

He said inflation is expected to taper off with fresh arrivals in market and significant improvement in monsoon. But the uneven rainfall may cause some concerns and needs to be monitored.

UPI Lite limit raised

The central bank also proposed to increase transaction payment limit to Rs 500 for UPI Lite in offline mode and announced other measures to further deepen the reach and use of digital payments in the country.

Presently, a limit of Rs 200 per transaction and an overall limit of Rs 2,000 per payment instrument has been prescribed by the Reserve Bank for small value digital payments in offline mode, including for National Common Mobility Card (NCMC) and UPI Lite.

By removing the need for two-factor authentication for small value transactions, these channels enable faster, reliable, and contactless mode of payments for everyday small value payments, transit payments etc.

The overall limit is, however, retained at Rs 2,000 to contain the risks associated with relaxation of two-factor authentication and instructions in this regard will be issued shortly, he added.