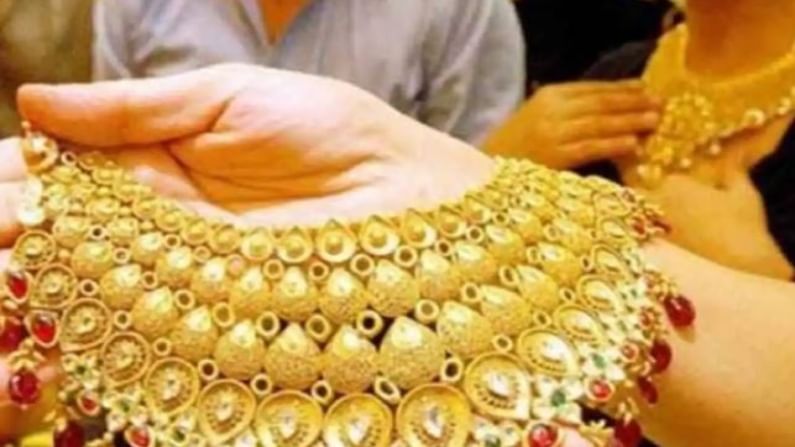

Should you buy gold amid rising Covid cases and lockdowns?

Here's what experts have to say about gold price movements

India is witnessing an unprecedented surge in Covid-19 cases on a daily basis. Cases have crossed the record 2.7 lakh mark in the last 24 hours alone.

While many states like had already imposed local restrictions and weekend lockdowns to contain the virus. Delhi Chief Minister Arvind Kejriwal on April 19 announced a 6-day lockdown.

Although the second wave has gripped the nation, gold prices have managed to rise from the recent lows. Gold prices in India have already jumped about Rs 3,000 per 10 gram in April from the levels of about Rs 44,000 at the start of the month amid positive global cues. Experts see gold prices rising further and re-testing Rs 50,000/ 10 gram levels in the near term.

Several global factors also are pushing the gold prices higher. Internationally, gold prices are hovering near a seven week high.

Here’s what experts have to say about gold price movements:

Anuj Gupta, VP, Commodity and Currency Research at IIFL Securities

Gold is always considered better than other asset classes in times of uncertainty. In 2020, when the Covid 19 pandemic hit the whole world, we saw that gold became one of the most attractive asset classes for the investors as it delivered more than 28% return.

Now, looking at the second wave of Covid-19, which is spreading much faster than the earlier wave, investors are advised to buy gold at the current levels as even now it is trading at a 16% discount to all time highs.

Since the equity markets are also correcting, gold prices are likely to further rise and may test Rs 52,000 by year end.

Kunal Shah, Head of Commodities Research, Nirmal Bang

Not just the second wave, there is geopolitical tension building up between US and China on Taiwan, Ukraine and Russia and even Iran and Israel. Fresh sanctions on Russia by the United States have also increased political risk and supported safe-haven buying in the precious metals last week. Such geo political tensions are weighing on the international gold prices.

On the other hand, China, the world’s biggest gold consumer, has stepped up bullion imports with a revival in demand.

Bond yields in developed economies have also cooled off which again is a very bullish sign for gold as this will push investors to the bullion as a refuge against possible inflation ahead.

In this way, factors both domestically and internationally are in favour of supporting the gold rally from here on.

In international markets, gold is trading at $1780 levels. One should therefore invest in gold in short to medium to term as we see international gold prices testing $1840 in the short term.

Gold prices in long term also look very bullish so for the long term investors and buyers, this could be a good time to invest in gold.

Vandana Bharti, AVP, Commodity Research · SMC Global

Gold has already come forward to play the role of saviour for investors as seen in the year 2020.

After a weak start in 2021 with aggressive vaccine drive, the demand for the safe haven appeared diminishing. However, now with the second wave, increasing uncertainty in equity as an asset class, downfall in dollar index and US Treasury, gold is back on the front foot.

Gold prices are now approaching Rs 48,000 on MCX. Looking at the factors supporting the rally, investors must look at buying gold on dips.