Should you invest in a largecap, midcap or smallcap mutual fund?

Deciding on a mutual fund category primarily depends on investor's financial goal, time horizon, risk-taking ability and resources

- Harsh Chauhan

- Last Updated : July 1, 2021, 16:13 IST

A strong rally in stock markets and surging valuation is making it difficult for investors to cherry-pick stocks at the right valuations which is why they are turning to mutual funds as an alternative. This quiet is evident from the fact that open-ended equity mutual funds saw net inflows of Rs 10,082.98 in the month of May 2021 highest in 14-months. Even the SIP contribution has been rising. According to data released by the Association of Mutual Funds in India (AMFI) the contributions under the systematic investment plan (SIP) touched their lifetime highs of Rs 8,818.90 crore in May 2021 versus Rs 8,596.25 crore witnessed in April 2021.

If you are looking to invest in mutual funds but confused about the category you should invest in, here’s some help.

Financial goals

As per most investment pundits deciding a mutual fund category primarily depends upon one’s investment goal, time horizon, risk-taking ability and resource position. “If you’re investing for a very long-term, for example, if you’re planning for retirement or education, something like that, when you when you have 10 years or more, then definitely you can allocate a little part of the corpus in smallcap fund,” explained Pankaj Mathpal, MD and CEO of Optima Money Managers.

On other hand if you want to invest for a horizon of 5 years then the mix should be 50-50 in large and midcap funds only, adds Mathpal. As smallcap funds have a higher risk compared to the other two funds since they invest in smaller companies that have high volatility in share prices.

Returns

Usually, largecap funds are known to offer stable and consistent returns. Since the companies in which these funds invest are generally leaders in their field of business and hence, tend to remain more stable when compared to small or mid-cap companies at times when the markets go volatile.

Midcap funds have the potential to provide higher returns as compared to largecap funds as the growth potential of the underlying companies is on the higher side. Midcap companies have the potential to beat the benchmark and large-cap funds when the markets are bullish. This is possible as the underlying stocks will tap into the growth opportunities.

Smallcap funds can outperform both large and midcap funds since these companies are relatively small, they have a very high potential to grow. But while investing in these funds one must keep in mind the financial thumb rule higher the returns higher is the risk and these funds can at times be volatile.

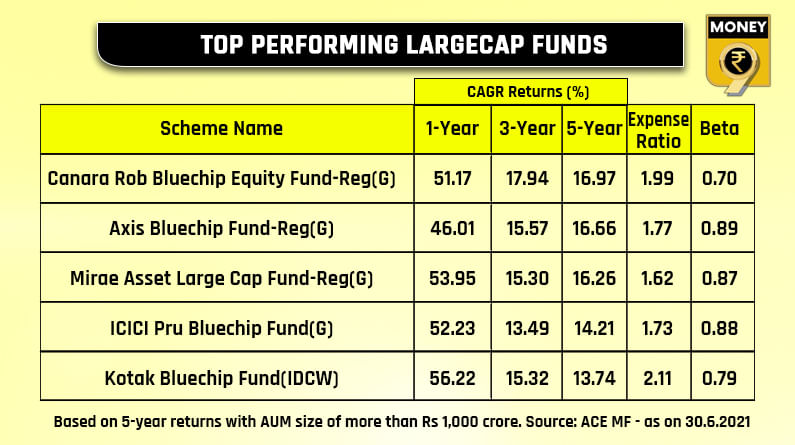

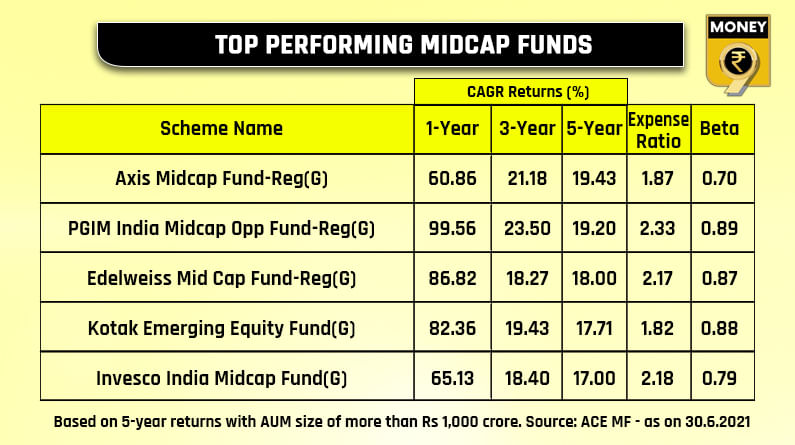

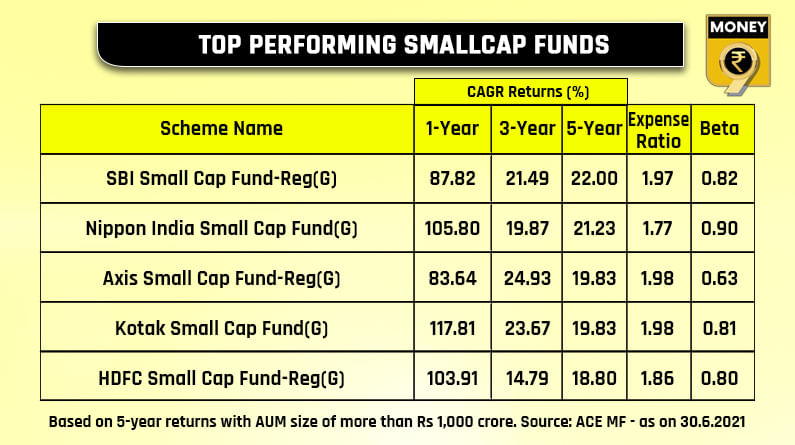

Top performing funds

To help you better understand the performance of largecap, midcap and smallcap funds in the past here is a list of top-performing funds along with their expense ratio and beta (compared to their benchmark index).

Beta denotes the sensitivity of the mutual fund towards market movements. It is the measure of the volatility of the mutual fund portfolio to the market. The beta of the market or benchmark is always taken as 1. Any beta less than 1 denotes lower volatility and higher than 1 denotes more volatility compared to the benchmark index.

“While past performance is just one aspect of analyzing a fund. Investors should closely look at a fund portfolio as a particular sector or a stock that is performing well today may not perform well in the future. Hence, it’s important to look at the sector and stock allocation within each fund and if it coincides with an individual investment profile and philosophy one can go ahead and invest,” advises Mathpal.

(Disclaimer: The above list is for informational purpose only. Before investing, please consult your financial adviser.)

Download Money9 App for the latest updates on Personal Finance.

Related

- पहली छमाही में रियल एस्टेट में संस्थागत निवेश 37% घटकर तीन अरब डॉलर रहने का अनुमान

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit