A lifestyle change: Your first step towards financial independence

Financial Independence: Having enough financial resources to deal with life's ups and downs without scrimping, sacrificing, or going deeply into debt

In this age of social media and hashtags, everyone wants to travel, wants to go for fancy dinners, and get noticed in their social circles. In doing so, one tends to surround oneself with many unwanted & unnecessary habits of spending money. But, while doing all these discretionary expenses one doesn’t realise what they are losing on, and that is one’s financial independence.

What is financial independence??

Everyone’s definition of financial freedom is unique and different depending on their needs and situations. However, it is a state in which an individual or household has sufficient wealth to live on without having to depend on income from some form of employment. In short, Financial Independence means, having enough financial resources to deal with life’s ups and downs without scrimping, sacrificing, or going deeply into debt.

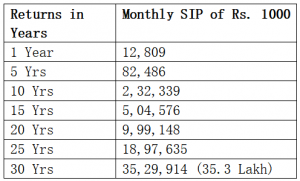

Now that we know the importance of financial independence, it’s time to re-look our lifestyles. Do you know by making a small change in lifestyle can be your first step towards financial independence? For instance, just skipping one dinner outing per month will leave you a Rs 1,000 surplus at the end of the month. And if this surplus, if channelized into credible investments, will leave you with Rs 82,486 at the end of 5 years. Well, if one is able to continue this habit for a longer duration the returns are much higher.

Now you must be inquisitive to know how small investment can create such good wealth mentioned in the table, and the answer to this is SIP.

What is SIP and how it works?

What is SIP and how it works?

A systematic Investment Plan (SIP) is an investment mode through which you can invest in mutual funds. As the term indicates, it is a systematic method of investing fixed amounts of money periodically. This can be monthly, quarterly, or semi-annually, etc… When you invest steadily in this manner, it can become easier to meet your financial goals. And, over a period of time, you will be able to create a great amount of wealth.

Another aspect that works for you when you are invested in is the power of compounding. Compounding interest in simple terms means the interest on interest. . “Each time you earn interest on your principal, it is added to the original amount, which then becomes the principal for the next cycle, hence even a small amount of Rs.1000 in long term can create good wealth in long term because of power of compounding. Longer the duration better the return,” says Pankaj Mathpal of Optima Money.

To make your money work smoothly you should put it in auto mode. If your financial plan isn’t on auto-pilot, change that immediately, says self-made millionaire David Bach. Automating your finances — sending your money automatically to investment accounts, savings accounts, and creditors allows you to build wealth effortlessly.

Hope you are now deciding which lifestyle change to make and start searching for which SIP to invest in.

Download Money9 App for the latest updates on Personal Finance.

Related

- पहली छमाही में रियल एस्टेट में संस्थागत निवेश 37% घटकर तीन अरब डॉलर रहने का अनुमान

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit