Even the trinity of Gods can't time the markets: Raamdeo Agarwal

To truly prosper in markets, one must learn the power of compounding and you should have patience, says Agarwal

At a time when the stock markets are hovering near all-time highs, there are increasing worries on when could the impending correction take place. Some analysts are warning of a bubble, looking at the market cap-to-GDP, the all-time high participation of retail investors, and the rising activity in the IPO space as red flags.

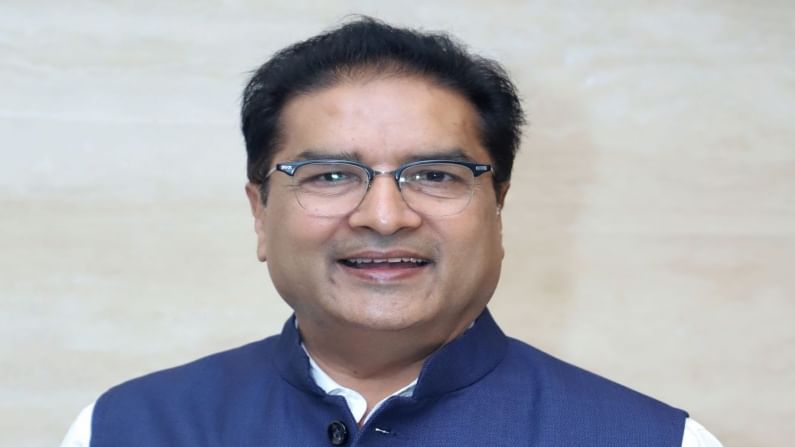

Raamdeo Agarwal, Chairman, Motilal Oswal Financial Services hopped on to the latest social networking destination, Clubhouse this week, to share insights with millennial investors who are sitting on the fence weighing all options before they jump into equity investments at this juncture.

The fear which most first-time investors have about investing in stocks is that the moment they’ll put in money, markets will reverse their move. Dispelling the doubts on this, the market veteran said, “If one feels this way, one must definitely invest in markets and take the cost.”

Don’t time the markets

“You cannot time the markets. Even if the Holy Trinity Brahma, Vishnu, Mahesh were to come together”, he said.

He also said that to truly prosper in markets, one must learn the power of compounding and you should have patience that this asset class will get you great returns. Very few understand and even fewer practice the power of compounding.

“In equity markets, you need to be present for all 365 days. If you are out of the markets for 5-6 best days, your return will be worse than that of fixed income and this is why you should not time the markets. Don’t come to equity markets if you want to time the markets”

Direct equities vs mutual funds

Speaking about whether for first-time investors it is better to invest directly in equities or should one invest via mutual funds, Agarwal said that if someone does not have time to track and analyse companies and their businesses then they can hire a mutual fund manager or go for PMS (Portfolio Managed Service) or AIFs (Alternate Investment Funds).

How do you select the right fund manager?

Agarwal said, “It is just like choosing the right employee. The past performance, the portfolio study, competence, and whether he or she is passionate. Say for instance now we are seeing a whole lot of digital companies coming to the fray but if the fund manager is not interested in studying new businesses and covering them, he will miss out on the new revolution.”

He said the qualities one must look for is passion, competence, learnability and integrity. Also he believes one must have two or three funds to have all values of growth in terms of large-caps, mid-caps and small-caps.

How does one judge the quality of a business?

Agarwal believes there are two types of businesses. Good business and bad business. A bulk of businesses almost 70% are bad businesses. Only 15-20% of businesses are good businesses. The quality of businesses can be judged by looking at return on equity (RoE) which is at what rate your money grows when you invest in a company. Apart from this, one must look for top-quality management.

“When good businesses come along with good management, then it makes a terrific combination. They can then deliver huge returns and create huge wealth”, he said.