SEBI overseas ETF: SEBI stops fresh investment in these mutual fund schemes!

SEBI overseas ETF: Mirae Asset NYSE FANG+ ETF HAS HIGHEST AUM in its lot.

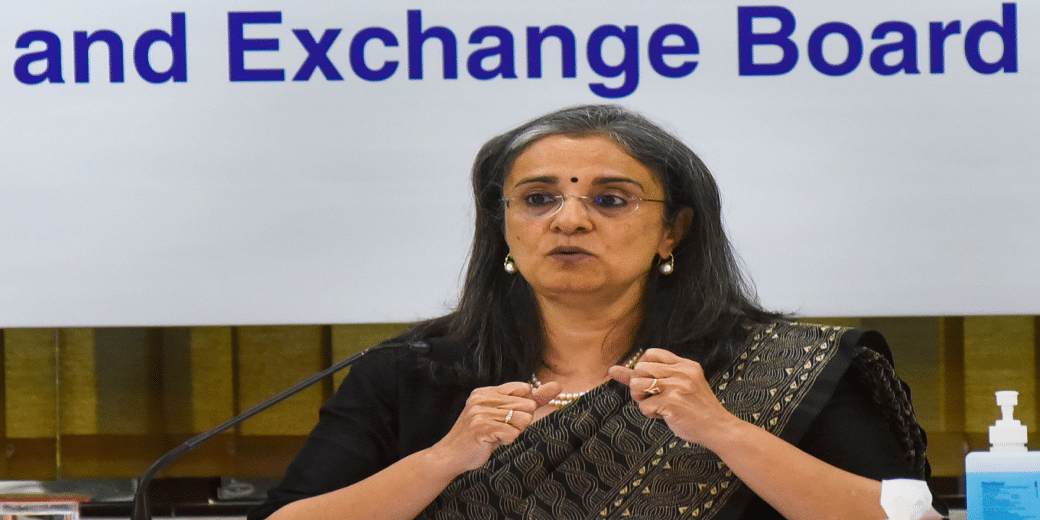

Capital market regulator, SEBI, has directed the Association of Mutual Funds in India (Amfi) to instruct fund houses to stop fresh subscriptions in overseas Exchange Traded Funds (ETFs) from April 1, 2024. The market watchdog took this decision as according to reports, such schemes (overseas ETFs) were about to breach overseas investment limit of $1 billion. SEBI has imposed this limit to protect investor interest. With, SEBI’s latest diktat, now, retail investors will not be able to invest in overseas ETFs.

According to discount stock broking platform, 5paisa.com, the following international ETFs have the highest AUM in India:

1. Mirae Asset NYSE FANG+ ETF

2. Motilal Oswal NASDAQ 100 ETF

3. Motilal Oswal Nasdaq Q 50 ETF

4. Nippon India ETF Hang Seng Bees

With Sebi’s latest diktat, retail investors will not be able to invest in these funds.

International or overseas ETFs are those schemes that track a particular overseas index and invest passively.

Reportedly, the SEBI has given one more direction. The regulator has instructed fund houses to calculate value of their international investment based on cost of acquisition of those securities and not on current market prices. This may serve as a relief for AMCs when markets would go up. As, in this case, the investment value derived would be lower and fund houses would have more room left to invest overseas.

The capital market regulator had earlier also banned investment in mutual funds that invested overseas back in 2022. But that pertained to all types of mutual fund schemes that bought foreign securities. According to the rules, AMCs’ foreign investment cannot breach $7 billion mark.

But, after SEBI’s the then diktat , there was correction in equity market globally, the value of overseas investment made by fund houses in India had reduced. Subsequently, the value of such investments fell below the prescribed limit of $7 billion, giving room for overseas investment. As a result, the fund houses again restarted investing in global securities from 2023. But, again, because of overall equity value surge, the value of overseas investment made by international ETFs increased and breached past the set limit of $1 billion. And, hence, the SEBI’s direction has come. Albeit, this time, the market watchdog has only banned fresh subscriptions in overseas ETFs. Other types of mutual fund schemes that invests overseas are still allowed to buy foreign securities.