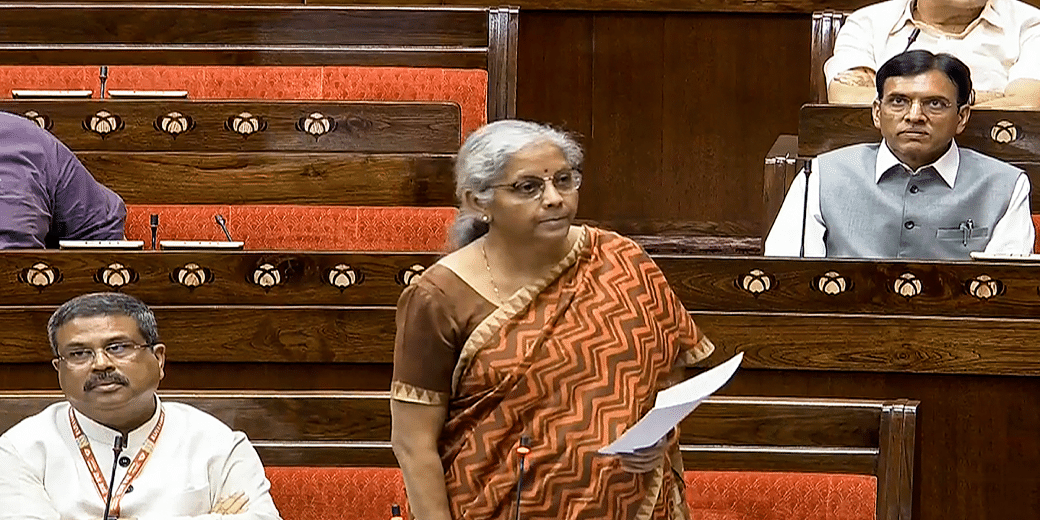

Finmin: India on path to achieve 6.5 per cent GDP in FY24

In the August edition of Monthly Economic Review, Finmin said the 7.8 per cent growth recorded in the first quarter was due to the strong domestic demand, consumption and investment.

The finance ministry on Friday said it was confident that the country would achieve 6.5 per cent growth in FY24 on improved corporate profitability, private capital formation and bank credit growth. It said the growth would be achieved despite rising crude oil prices and monsoon deficit.

In the August edition of Monthly Economic Review, Finmin said the 7.8 per cent growth recorded in the first quarter was due to the strong domestic demand, consumption and investment. The review said the impact of rising crude oil prices and monsoon deficit on kharif and rabi crops needs to be assessed. At the same time, it said , the rains in September have reduced a part of the deficit. Further, a stock market correction is an ever present risk, and offsetting these risks are the bright spots of corporate profitability, private sector capital formation, bank credit growth and activity in the construction sector, the review said. “In sum, we remain comfortable with our 6.5 per cent real GDP growth estimate for FY24 with symmetric risks,” it said. Observing that the strength of domestic investment is the result of the government’s continued emphasis on capital expenditure, the report said, measures implemented by the central government have also incentivised states to increase their capex spending.

The external demand has further complemented the domestic growth stimulus, it said, adding, the contribution of net exports to GDP growth has increased in Q1FY24, as services exports have performed well. High Frequency Indicators (HFIs) for July/August 2023 reflect sustenance of growth momentum in Q2FY24, it said. With regard to the banking sector, it said, a variety of indicators suggest increasing resilience of the sector through declining Non-Performing Assets (NPA), improving Capital to Risk-weighted Asset Ratio (CRAR), rising Return on Assets (RoA) and Return on Equity (RoE) as of March 2023.

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit

- Worst deposit crunch in 2 decades, RBI urges banks to explore new ways to increase deposits

- Health insurance vs. Medical corpus: What’s your choice?

- Labour groups demand special fund for informal sector in Budget’24

- Have you taken the ‘No Spend Challenge’?