Covid-19 crisis: RBI announces loan recast for individuals, small businesses

RBI said individuals and small businesses with aggregate exposure of up to Rs 25 crores and those who have not taken restructuring earlier and were classified as standard as of March 31, 2021, will be eligible to be considered. The restructuring may be invoked up to September 30.

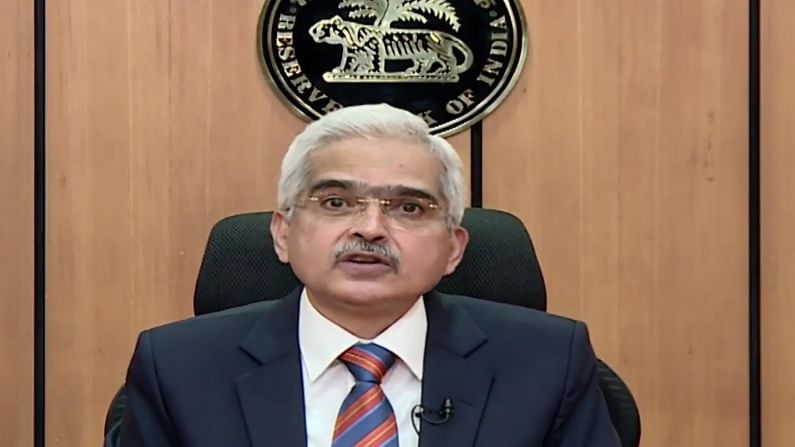

RBI Governor Shaktikanta Das on May 5 announced new measures to tackle the economic impact of the second wave of the deadly coronavirus. The RBI Governor said the situation has reversed from being on the foothills of strong economic recovery to facing a fresh crisis. He assured that the RBI will continue to monitor the situation from the resurgence of COVID-19 cases and deploy all the resources.

Key announcements:

Priority lending by banks for Covid-related healthcare infrastructure

A liquidity window of Rs 50,000 crore with tenure of up to 3 years at repo rate being opened till March 31st, 2022. Under the scheme, banks can support entities including vaccine manufacturers, medical facilities, hospitals, and also patients.

This lending will get priority sector classification till repayment or maturity. Banks will also create a Covid loan book under the scheme

For Individual and small business borrowers

Opening of one-time restructuring for individuals, MSMEs, and small businesses. Individuals and MSMEs borrowers will be permitted one-time restructuring till September 30, 2021. Under restructuring 1.0, the period of moratorium can be extended up to a total of 2 years.

RBI Governor said individuals and small businesses with aggregate exposure of up to Rs 25 crores and those who have not taken restructuring earlier and were classified as standard as of March 31, 2021, will be eligible to be considered. The restructuring may be invoked up to September 30.

Rationalization of KYC compliance norms and provide for video-based KYC for certain categories

Relaxation of the rules for availing overdraft facility for state govt up to Sept 30, 2021

Here is the full address:

Address by Shri Shaktikanta Das, RBI Governor https://t.co/rBtDp1xwHb

— ReserveBankOfIndia (@RBI) May 5, 2021

Corporate view

After 9 months of buoyant consumer demand, I can see a weakness in demand emerging because of poor consumer sentiment due to the raging pandemic, inflation raising its head, medical expenses taking away part of the savings and with Covid hitting villages, rural demand is effected

— Harsh Goenka (@hvgoenka) May 5, 2021

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की