RBI’s MPC likely to maintain status quo on interest rate

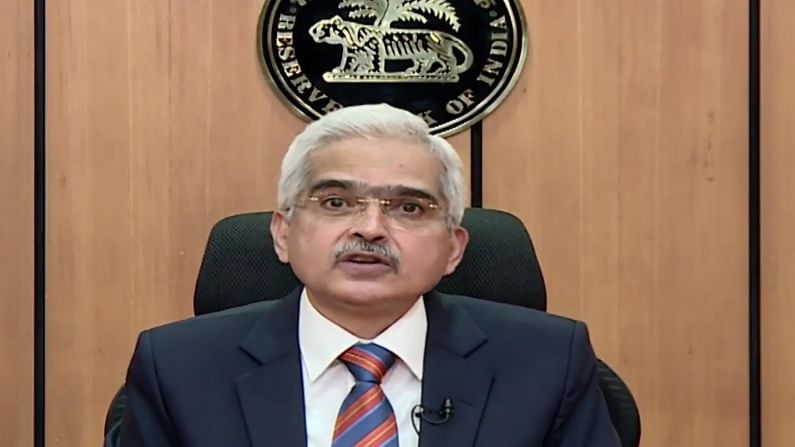

Reserve Bank Governor Shaktikanta Das will unveil the resolution of the Monetary Policy Committee (MPC) on Friday

The RBI’s rate-setting panel MPC began its three-day deliberations on Wednesday to finalise the bi-monthly monetary policy amid expectations that it may opt for status quo on interest rate on account of inflationary concerns. Reserve Bank Governor Shaktikanta Das will unveil the resolution of the Monetary Policy Committee (MPC) on Friday.

Headed by the RBI Governor, the six-member MPC also includes three external members.

Experts are of the view that the RBI may prefer to wait and watch for some more time before taking any major action on the monetary policy front as the central bank’s focus is on managing inflation as well supporting economic growth.

The central bank had left the benchmark interest rate unchanged at 4% at the June policy meet. It was for the sixth time in a row that the MPC maintained status quo on interest rate.

Inflation is expected to remain high due to international commodity price trends and persisting supply-side constraints arising out of the second wave of the pandemic.

The Reserve Bank, which mainly factors in the retail inflation while arriving at its monetary policy, has been mandated by the government to keep the Consumer Price Index (CPI) based inflation at 4% with a margin of 2% on either side.

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की