Which private bank is giving highest interest on FDs?

RBL Bank is giving highest of 7.80 per cent RoI on FDs of 15 months to less than 2 years. Elderly will get 8.30 per cent interest rate.

- Kanishka Birat

- Last Updated : August 29, 2023, 17:54 IST

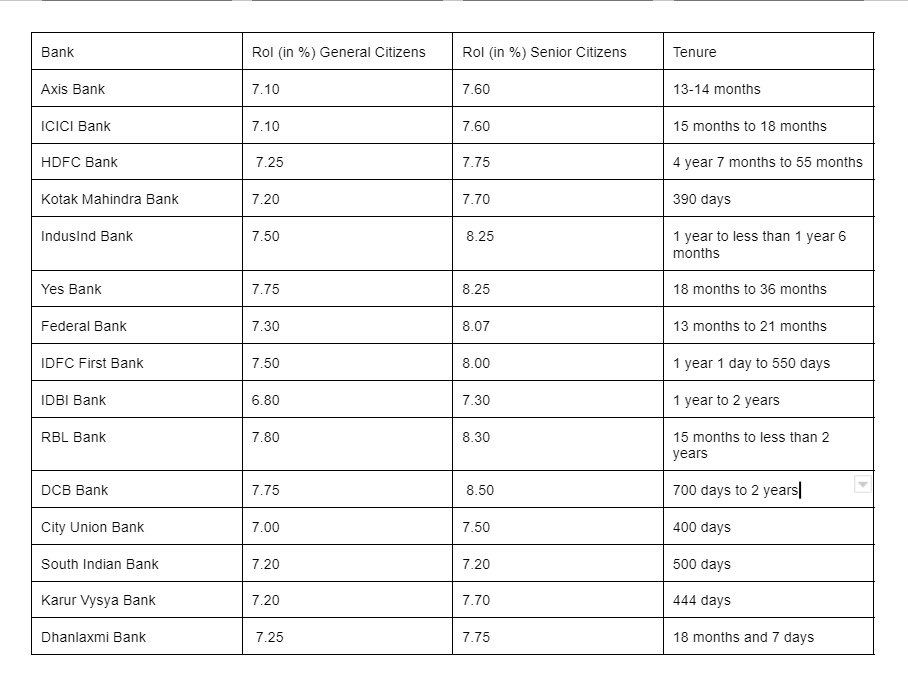

Axis Bank has revised fixed deposit interest rates. Account holders can now earn 7.10 per cent interest on FDs of 13-14 months with the private lender. Let’s see the highest interest rates account holders can get on opening of FDs with other private lenders as well.

ICICI Bank is also giving as high as 7.10 per cent but on FDs of 15 months to 18 months.

The ICICI Bank also increased fixed deposit interest rates but only on bulk deposits i.e. on minimum deposits of Rs 2 crore and above. On bulk FDs with ICICI Bank, account holders can get as high as 7.25 per cent interest on deposits of 1 year to 389 days.

Coming back to fixed deposits with deposits of less than Rs 2 crore, HDFC Bank is giving interest rate of as high as 7.25 per cent on FDs of 4 year 7 months to 55 months. With Kerela based Dhanlaxmi Bank also, depositors can get as high as 7.25 per cent rate. But for this, they will have to open the FD for 18 months and 7 days.

While, with Kotak Mahindra Bank, account holders can get highest of 7.20 per cent interest rate on 390 days FDs.

All the banks mentioned above will give 0.50 per cent additional rate to senior citizens over and above rates applicable on FDs with mentioned tenures.

Highest RoI currently given by private banks on FDs:

IndusInd Bank on the other hand is giving as high as 7.50 per cent interest on FDs of 1 year to less than 1 year 6 months. The Mumbai based lender is giving 0.75 per cent additional rate to senior citizens. Elderly will get 8.25 per cent interest on this FD.

IDFC First Bank is also giving RoI of 7.50 per cent on FDs of 1 year 1 day to 550 days. Senior citizens will get 8 per cent on this FD.

While, Yes Bank is giving interest rate of as high as 7.75 per cent on FDs of 18 months to 36 months.

Federal Bank on the other hand is giving interest rate of as high as 7.30 per cent on FDs of 13 months to 21 months. Federal Bank is giving 0.77 per cent additional rate to senior citizens. Elderly will get 8.07 per cent interest on FD of this particular tenure.

RBL Bank is giving highest of 7.80 per cent RoI on FDs of 15 months to less than 2 years. Elderly will get 8.30 per cent interest rate.

If account holders open FD with DCB Bank, then, they can get as high as 7.75 per cent RoI. But for this they will have to open the FD for 700 days to 2 years. DCB Bank is giving 0.75 per cent additional rate to senior citizens. Elderly will get 8.50 per cent interest rate on this FD.

If account holders open FD with South Indian Bank, then, they can get as high as 7.20 per cent RoI. But for this they will have to open the FD for 500 days. But senior citizens will get similar rate on this FD. Elderly will not get any additional rate on FD of this particular tenure.

Even with Karur Vysya Bank, depositors can get as high as 7.20 per cent RoI. But for this, they will have to open FD of 444 days.

On the other hand, account holders will get highest return of 6.80 per cent on fixed deposits opened with IDBI Bank. They will get this much rate of interest on FDs of 1 year to 2 years. Senior citizens will get 0.50 per cent additional rate.

On FDs of 400 days with City Union Bank, account holders can get highest of 7 per cent interest rate.

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की