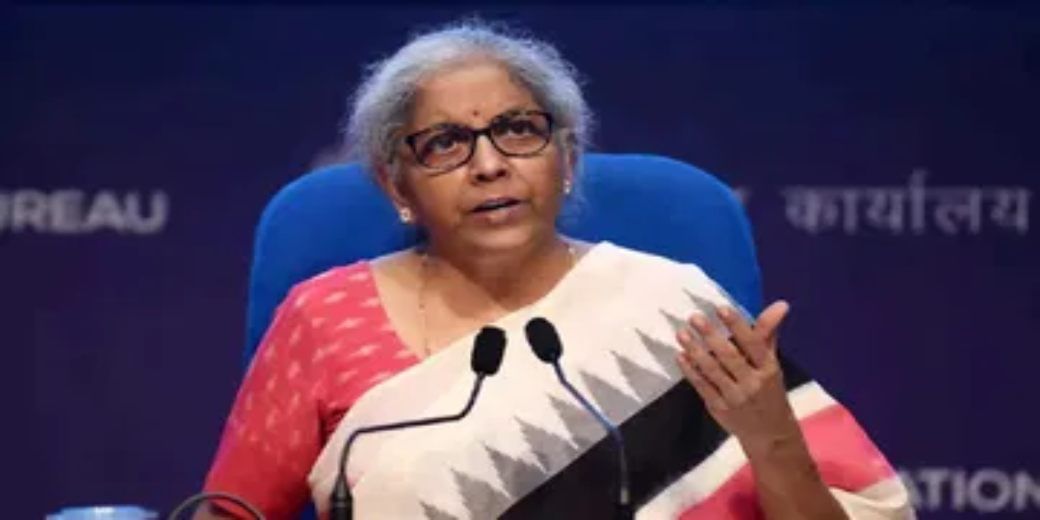

FM emphasises transparency in reporting bad loans

The finance minister’s statement came at a time when Indian banks are boasting of one of their cleanest balance sheets in well over a decade

Public sector banks must adhere to a “fair and transparent recognition” of bad loans, Union finance minister Nirmala Sitharaman said while reviewing their performance on Thursday. The finance minister’s statement came at a time when Indian banks are boasting of one of their cleanest balance sheets in well over a decade.

She urged the banks to follow rigorous risk mitigation and management practices so that they can continue to coast on the path of growth profitability.

One of the primary points of her address was to urge the banks to be prepared for meeting the credit demands for a growing economy that the country is managing to achieve despite the headwinds of slow down in major markets such as the US, the Eurozone and China apart from geopolitical tension points.

Incidentally, according to research reports the net non-performing assets of banks have dipped to about 1% while gross NPAs are around 4%. It was way back in 2008 – a good 15 years ago – that net NPAs went down to the 1% mark.

Gross NPA of public sector banks stood at 4.97% and net NPA at 1.24%.

The cleaning up of the books of public sector banks have also produced sparkling bottom lines – PSBs earned a cumulative aggregate net profit of around Rs 1.05 lakh crore in 2022-23. The amount is not only a record but also almost three times of what was earned in 2013-14.

According to a statement issued by the ministry, the review meeting with the top management of PSBs focussed on the macro trends, improved business sentiment, ‘twin balance sheet advantage’ and performance of the state-run banks.

It was noted that the performance of the banks made quantum leaps in vital financial parameters such as asset quality, credit deployment, profitability and capital adequacy.

It was also observed that the banks are fortified with high capital to risk-weighted assets ratio 15.53% and clean balance sheets supported by a provision coverage (90.68%) and all these equip the banks to adequately support the credit needs of the growing economy.

The finance minister also told the banks to ensure smooth flow of credit to the rural and agricultural sectors with an emphasis to meet priority sector lending norms in different sub-categories. She also urged the chiefs of the banks to meet the target for programmes such as PM Street Vendor’s AtmaNirbhar Nidhi.

Sitharaman also said that sponsor banks of regional rural banks should undertake time-bound technological upgradation and keep monitoring their performance to make them efficient and effective, which would benefit the underbanked rural population.