Covid-19 treatment: Documents you need to submit to make cash payments at hospitals

The rule is applicable for the period April 1, 2021 to May 31, 2021

- Teena Jain Kaushal

- Last Updated : May 8, 2021, 13:57 IST

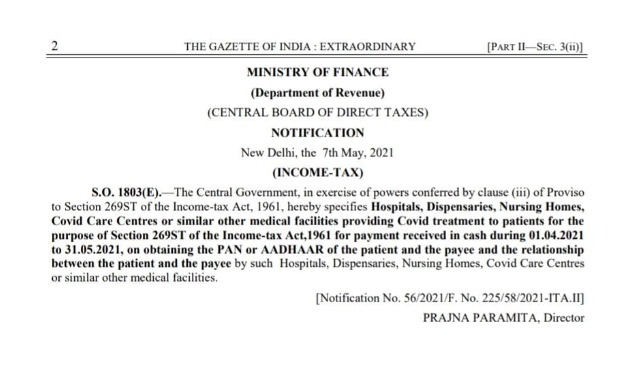

With an aim to provide relief to people who are not comfortable with online banking or digital modes of payments, the government has allowed hospitals and medical facilities providing Covid-19 treatment to receive cash payments of Rs 2 lakh or more. The rule is applicable for the period April 1, 2021 to May 31, 2021. But the government has also notified that certain documents need to be provided to use this facility.

First, patient should submit PAN or Aadhaar number. Second, in case of payment is not being made by the patient then PAN and Aadhaar of that individual. Third, the relationship between the payee with the patient needs to be disclosed. Currently, according to Section 269ST of the Income-Tax Act, any receipt of Rs 2 lakh or more in cash may attract a penalty of 100%. The provision was introduced after demonetisation in 2016. But during these unprecedented times, when the second wave has ravaged the country, the relaxation has been brought to ease the troubles faced by people.

While many see it as a welcome move considering people in small-towns and cities are generally not comfortable making digital payments shy, others say the need for PAN or Aadhaar card could have been done away with.

Expert view

“I am of the view that considering the crisis of the century, the approach should be very liberal. The circular should have given a general exemption without any condition. Now from where the patient gets PAN, Aadhar if it not readily available. Immediate treatment is far more important. Further asking for PAN or Aadhar of a relative who is helping will discourage people financially supporting a patient in crisis,” said Ved Jain, former president of the Institute of Chartered Accountants of India.

Considering the second wave of Covid-19 is making inroads into the rural areas, paying through online banking can be a big challenge for them, especially visiting the branch for NEFT and IMPS in this time of crisis. But there have been many instances where people have to borrow money so that they can afford the treatment. Experts say in such cases, providing PAN or Aadhaar card can be challenging.

“There may be cases where not one but many relatives will be contributing to the treatment of one patient. It can be a contribution or a loan. One wonders besides these conditions, how other restrictions of accepting a loan of Rs 20,000 or more will be complied with in such a situation. In this unprecedented crisis, a person borrows from everyone near and dear to meet his or his relative’s treatment cost. The government should understand the gravity of the situation and no questions should be asked for a source of payment of hospital bills for treatment of Covid and let hospital accept payment in cash or otherwise with no condition,” said Jain.

Download Money9 App for the latest updates on Personal Finance.

Related

- मदर ऑफ ऑल डील भारत के लिए फायदेमंद, बढ़ेगा एक्सपोर्ट और रोजगार

- दिल्ली को देश का आर्थिक केंद्र बनाने की जरूरत: मुख्यमंत्री रेखा गुप्ता

- बजट में नीतिगत निरंतरता, सीमा शुल्क सुधारों पर ध्यान दे सरकार: स्कोडा ऑटो फॉक्सवैगन

- छह गीगाहर्ट्ज बैंड में 500 मेगाहर्ट्ज का स्पेक्ट्रम लाइसेंस से मुक्त, वाई-फाई को मिलेगा बढ़ावा

- आवासीय रियल एस्टेट का रुझान बदला, अब महंगे-बड़े घरों का बोलबालाः रिपोर्ट

- डब्ल्यूईएफ 2026: अदाणी समूह ने भारत के लिए 66 अरब डॉलर के निवेश की योजना की प्रस्तुत