Rs 10 lakh invested 21 yrs ago is now Rs 5.49 cr!

The ICICI Prudential Multi-Asset Fund has completed 21 years existence

The ICICI Prudential Multi-Asset Fund has completed 21 years existence. The scheme has Rs 24,060.99 crore of assets under management which is nearly 57% of the total AUM in the multi-asset allocation category. This indicates significant trust of investors in the scheme, the fund house said in a statement.

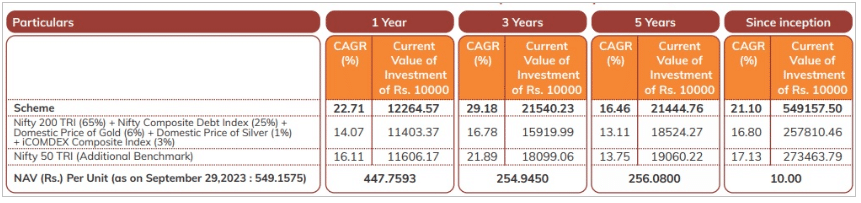

The fund said if an investor had made a lump sum investment of Rs 10 lakh 21 years ago, that would be worth Rs 5.49 crore as on September 30 this year, giving a 21% CAGR. A similar investment in Scheme benchmark – Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%) – would have yielded approximately Rs. 2.57 crs i.e. CAGR of 16%.

In terms of SIP performance, a monthly investment of Rs 10,000 via SIP since the inception, which would amount to a total investment of Rs 25.2 lakh, would have grown to Rs 2.1 crore as of September 30 i.e. a CAGR of 17.5%. A similar investment in the scheme’s benchmark would have yielded a CAGR of 13.7%.

Speaking on the occasion, Nimesh Shah, MD & CEO of ICICI Prudential AMC said the “wealth creation journey of ICICI Prudential Multi-Asset Fund is a testament to the fact that judicious asset allocation across asset classes works well for the investor over the long term.”

On the fund’s strategy, S Naren, ED & CIO, ICICI Prudential AMC said, “The performance of several asset classes over the previous decade and beyond shows that the top-performing asset class has changed every other year. Spreading one’s allocation across asset classes is one of the way to profit in this scenario so that the portfolio as a whole may take advantage of the potential gains and benefits that each asset class offers.

ICICI Prudential Multi-Asset Fund is an open ended scheme investing in Equity, Debt and Exchange Traded Commodity Derivatives/units of Gold ETFs/units of REITs & InvITs/Preference shares.

Download Money9 App for the latest updates on Personal Finance.

Related

- मदर ऑफ ऑल डील भारत के लिए फायदेमंद, बढ़ेगा एक्सपोर्ट और रोजगार

- दिल्ली को देश का आर्थिक केंद्र बनाने की जरूरत: मुख्यमंत्री रेखा गुप्ता

- बजट में नीतिगत निरंतरता, सीमा शुल्क सुधारों पर ध्यान दे सरकार: स्कोडा ऑटो फॉक्सवैगन

- छह गीगाहर्ट्ज बैंड में 500 मेगाहर्ट्ज का स्पेक्ट्रम लाइसेंस से मुक्त, वाई-फाई को मिलेगा बढ़ावा

- आवासीय रियल एस्टेट का रुझान बदला, अब महंगे-बड़े घरों का बोलबालाः रिपोर्ट

- डब्ल्यूईएफ 2026: अदाणी समूह ने भारत के लिए 66 अरब डॉलर के निवेश की योजना की प्रस्तुत