Here are the best performing focused equity mutual funds to invest in

Focused funds concentrate on creating a portfolio by restricting investments to high conviction stocks with optimal diversification

We all know being focused on one thing for a certain period allows us to do a better quality of work, more work gets done quicker, being less stressed and happier. The same stands true even for investing. Investing with a focus helps you eliminate the disturbance, concentrate on quality assets that help to create wealth in the long-term. If you are someone who is looking for a product that focuses on a particular investment rationale, then focused funds are for you. Let’s first understand what focused funds are

Focused funds

Focused funds, as the name suggest, concentrates on creating a portfolio by restricting investments to high conviction stocks with optimal diversification. As per SEBI’s mandate, a focused fund can invest in a maximum of 30 stocks with a minimum exposure of 65% of the portfolio in equity and equity-related instruments. Focused funds can invest across market capitalization – i.e., large-cap, mid-cap and small-cap.

Understanding the risks

While the fundamental philosophy of investment is not to put all eggs in one basket – aim for diversification. Focused funds defies this philosophy as the rationale here is too many stocks in the portfolio may dilute the benefits of performing stocks. This results in them not being diversified and that can the source of risk. The risk these funds carry is higher than diversified mutual funds like multi-cap funds.

Investment horizon

A polarized market (when only a few stocks/sectors are rallying) focused funds tend to beat the broader market. However, in the broad-based market rally, they might underperform. Hence an investor needs to keep this in mind and have the patience to invest for a longer tenure of five years or more.

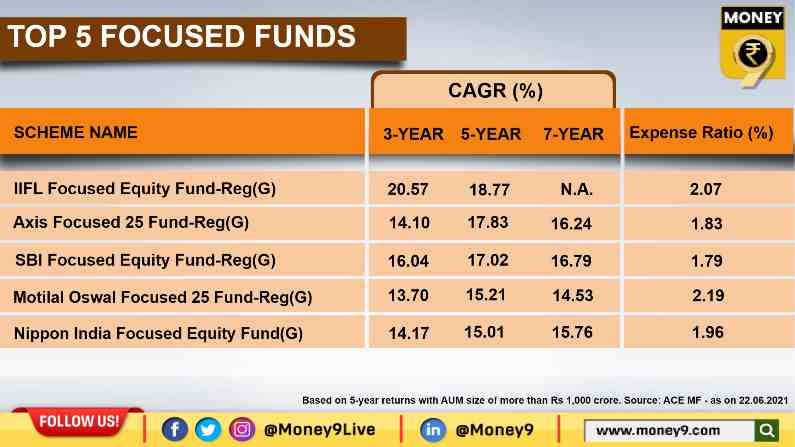

Best performing focused funds

Now that you have understood what focused funds are, its investment horizon, and the risks associated with them. Here is a look at the top five focused funds:

Best performing focused funds

Tax implications

When you redeem the units of a Mid Cap Fund, you earn taxable capital gains. The rate at which you will be taxed depends on the period for which you stayed invested in the scheme – the holding period. The tax rates are as follows:

Short Term Capital Gain (STCG) – A holding period of up to one year. STCG is taxed at 15%.

Long Term Capital Gain (LTCG) – A holding period of more than one year. There is no tax on LTCG of up to Rs. 1 lakh. Above this amount, LTCG is taxed at the rate of 10% without the benefit of indexation.

(Disclaimer: The above list is for informational purpose only. Before investing, please consult your financial adviser.)

Download Money9 App for the latest updates on Personal Finance.

Related

- इक्विटी म्यूचुअल फंड में निवेश मई में 21.66 प्रतिशत घटकर 19,013 करोड़ रुपये

- जियो ब्लैकरॉक म्यूचुअल फंड ने शीर्ष स्तर पर अधिकारियों की नियुक्ति की

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा