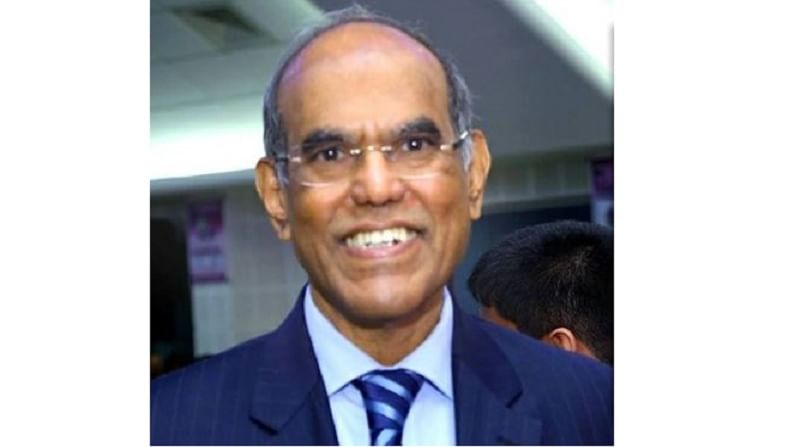

Inflation targeting has worked well, Centre must stay with it: Former RBI Governor D Subbarao

D Subbarao said the government's proposal to privatise some PSUs is not akin to selling family silver but it is a route for putting India on a sustainable growth path

- Press Trust of India

- Last Updated : March 25, 2021, 16:53 IST

New Delhi: Inflation targeting has worked well and the government must stay with it, and it is going to work well in the period ahead also, former RBI Governor D Subbarao said on March 25. He also said low inflation contributes to sustainable growth.

Addressing the ‘Times Network India Economic Conclave’ virtually, Subbarao further said the government’s proposal to privatise some public sector units (PSUs) is not akin to selling family silver but it is a route for putting India on a sustainable growth path.

“There is indeed no tension between growth and inflation in the medium term. Low inflation contributes to sustainable growth as it allows consumers and investors to make informed decisions.

“…So, I believe inflation targeting has worked well and we must stay with it and it is going to work well in the period ahead,” he said.

Under the current dispensation, the Reserve Bank of India (RBI) has been mandated by the government to maintain retail inflation at 4%, with a margin of 2% on either side. The six-member Monetary Policy Committee (MPC), headed by the RBI governor, decides on policy rates keeping this target in mind.

The current medium-term inflation target, which was notified in August 2016, ends on March 31, and the inflation target for the next five years starting April is likely to be notified this month.

Replying to a question on the government’s privatisation and asset monetisation programme, the former RBI governor said that at the time of independence, there was a logic to invest in the public sector units because there was no private capital.

Subbarao noted that now, when there is no dearth of private capital, the government should focus its energies on investing in education, health and other people-centric areas.

The government has budgeted Rs 1.75 lakh crore from stake sale in public sector companies and financial institutions, including two public sector banks and one general insurance company, in the next fiscal year beginning April 1.

Last month, Prime Minister Narendra Modi had said that 100 underutilised or unutilised assets with public sector units (PSUs), such as those in the oil & gas and power sectors, will be monetised, creating Rs 2.5 lakh crore of investment opportunities.

He also emphasised that the Centre cannot itself deliver on growth without the cooperation of states.

“Today, farm law reforms and land law reforms cannot be implemented without cooperation of states. Today, second-generation reforms need the active cooperation, consent of states, and the Government of India cannot do this by itself,” Subbaro said.

The former RBI governor said that if he were to advise the prime minister, he would tell the PM that “your job and mandate is to accelerate the growth rate and make sure that the benefits of growth reach the bottom half of the population”.

“That alone will secure your place in history, will secure your legacy,” Subbarao asserted.

He said the second and more important concern is that the economic crisis in the wake of the pandemic has accentuated inequalities. “We talk about V-shaped recovery, actually, it is a K-shaped recovery.” Stating that India’s economy is likely to contract 8% this fiscal, Subbarao said that even as there is going to be a rebound in economic growth next fiscal year, at the end of fiscal 2021-22, India’s economic output will be still lower than the pre-COVID-19 period.

The RBI has projected a gross domestic product (GDP) growth rate of 10.5% for the financial year beginning April 1, while the International Monetary Fund (IMF) has projected an 11.5% growth.

Noting that no emerging economy has grown 7% without high exports growth, he said India needs to grow its exports as the country still has a comparative advantage to produce for global markets.

He also said India is not going to exploit demographic dividend unless the country is able to provide jobs.

Download Money9 App for the latest updates on Personal Finance.

Related

- मदर ऑफ ऑल डील भारत के लिए फायदेमंद, बढ़ेगा एक्सपोर्ट और रोजगार

- दिल्ली को देश का आर्थिक केंद्र बनाने की जरूरत: मुख्यमंत्री रेखा गुप्ता

- बजट में नीतिगत निरंतरता, सीमा शुल्क सुधारों पर ध्यान दे सरकार: स्कोडा ऑटो फॉक्सवैगन

- छह गीगाहर्ट्ज बैंड में 500 मेगाहर्ट्ज का स्पेक्ट्रम लाइसेंस से मुक्त, वाई-फाई को मिलेगा बढ़ावा

- आवासीय रियल एस्टेट का रुझान बदला, अब महंगे-बड़े घरों का बोलबालाः रिपोर्ट

- डब्ल्यूईएफ 2026: अदाणी समूह ने भारत के लिए 66 अरब डॉलर के निवेश की योजना की प्रस्तुत