Which is the better route to invest in mutual funds? Lump-sum or SIP?

- Hemanshi Tewari

- Last Updated : January 20, 2021, 05:45 IST

One of the best ways to invest your money can be in mutual funds. It pools money from different investors and invests that money in other stocks or bonds. There are two ways in which you can invest money in Mutual Funds: Lump-sum and Systematic Investment Plan (SIP). Under Lump-sum, the investments are made in one go, while in SIP, a fixed amount is invested at fixed intervals of time. The fixed intervals can be yearly, quarterly, monthly or daily.

But, which mode is better to invest in Mutual funds? Lump-sum or SIP? To simplify both the investment routes, Money9 talks to a personal finance expert Tanvir Alam, Founder, Fincart Investment Planners Private Limited.

Alam explains both the investment routes with the help of an example.

Lump-sum mode of investment

Suppose you have Rs 1,20,000 to invest. Via the Lump-sum route, the amount is invested in one shot.

SYSTEMATIC INVESTMENT PLAN (SIP)

SIP is a disciplined approach of investing at a regular frequency (mostly on monthly basis). This works like a recurring deposit. A person invests Rs 10,000 per month, eventually, it adds up to Rs 1,20,000 in a year.

“The one-time investment of 120,000 is invested for the complete 12 months whereas the monthly SIP investments are in instalments of Rs 10,000. The first one is for 12 months, the second for 11 months and so on. Hence, the amounts average out to Rs 60,000 (Rs, 120,000 divided by 2) in a year. Theoretically going by this simple concept of the time value of money, the lump-sum investments should work better than monthly SIP,” Tanvir explains.

He further said, “However, there are scenarios where lump-sum could work and there are scenarios where SIP work better.”

Lump-sum or sip?

Whether an investor should choose Lump-sum or SIP totally depends on the market conditions. When the market is volatile, investments via Lump-sum can be a bit risky.

When is Lump-sum better than sip?

An investor can reap higher return via Lump-sum under two scenarios.

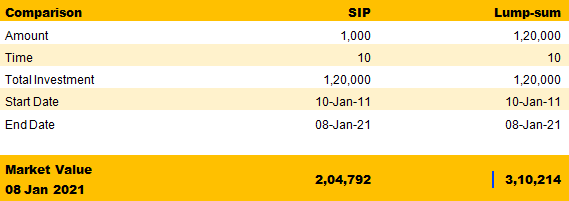

“If the investor invests the money for a very long-term period of 10 years & above, does not get bothered by market volatility and sits through the investment, will most likely outperform the SIP investments of 10 years. It compares an existing Equity Mutual Fund scheme over a 10 years investment horizon,” Alam asserted.

Lump-sum vs SIP comparison: Table 1

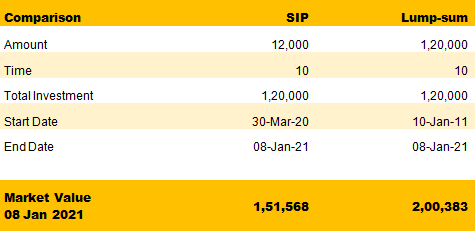

Alam further explains the second scenario. He tells, “Over a short-term horizon lump-sum can only outperform if the money gets invested at very low valuations and the market moves up. The markets corrected very sharply after the Covid19 pandemic break-out in March 2020. The markets corrected sharply and dropped below 26000 levels. Any investor who invested lump-sum at such a level say between 26K – 30K levels would have made a better return when compared to SIP.”

Lump-sum vs SIP comparison: Table 2

Albeit there are some challenges with the above two scenarios as well. Firstly, it is very difficult to time the market. Secondly, Most of the time the markets trade at above-average PE valuation level. “The opportunity of investing at lower market valuations comes when there is a lot of pessimism, hence the majority of people are not able to take advantage of the same,” Tanvir explains.

Money 9 says, it is always better to invest regularly than in one go. Investing via SIP is less risky as money is spread out over time and it also allows you to invest across market levels.

Download Money9 App for the latest updates on Personal Finance.

Related

- इक्विटी म्यूचुअल फंड में निवेश मई में 21.66 प्रतिशत घटकर 19,013 करोड़ रुपये

- जियो ब्लैकरॉक म्यूचुअल फंड ने शीर्ष स्तर पर अधिकारियों की नियुक्ति की

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा